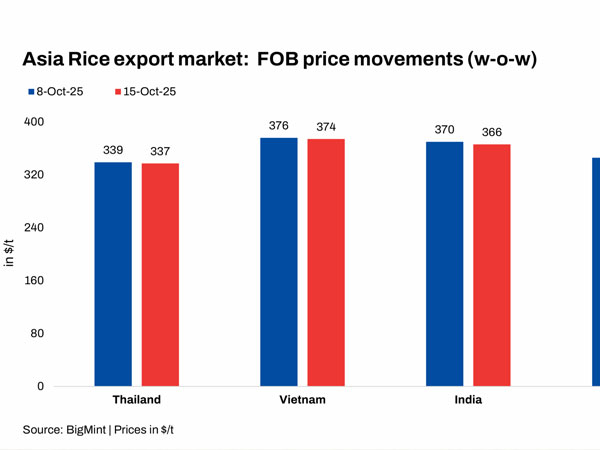

Rice prices across Asia have plunged to multi-year lows, led by Thailand's benchmark 5% broken variety dropping to $335-340/tonne (t), the lowest since 2007. Abundant supplies, slow overseas demand, and import restrictions from key buyers have weighed heavily on the market.

Rice prices across Asia have plunged to multi-year lows, led by Thailand's benchmark 5% broken variety dropping to $335-340/tonne (t), the lowest since 2007. Abundant supplies, slow overseas demand, and import restrictions from key buyers have weighed heavily on the market.

In Vietnam, export prices of 5% broken rice slipped to $374-378/t, while domestic prices in the Mekong Delta fell slightly to VND 8,100-8,200/kg. September exports dropped 41% y-o-y to 483,000 t, bringing total shipments in the first nine months to 6.9 million tonnes (mnt), down 1.6% in volume. The prolonged import suspension by the Philippines, Vietnam's largest buyer, further dampened trade sentiment.

India's white rice exports also remained under pressure, with 5% broken prices at $360-370/t, near their lowest since 2016, as buyers deferred purchases amid stable supplies and cautious global demand.

In contrast, Bangladesh continued to face firm domestic prices up about 15% over the past year, driven by higher milling and logistics costs, despite a healthy harvest. The government recently approved the purchase of 50,000 t of Indian rice at $359.77/t to stabilise local markets.

With strong harvest prospects and muted import demand, Asian rice exporters are likely to face a prolonged period of price pressure. Any recovery will depend on renewed government tenders or seasonal restocking by key importing nations.

© Copyright 2025 The SSResource Media.

All rights reserved.