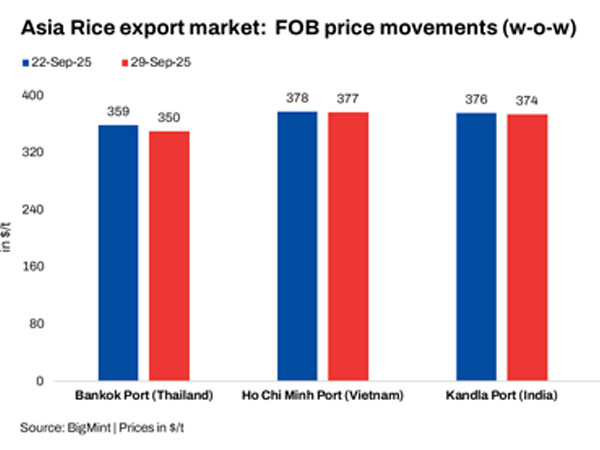

Export quotations for non-basmati 5% broken rice across major Asian ports declined in the week to 29 September 2025, tracking ample global availability and weak import interest. Traders report that elevated inventories in India-the world's top shipper-combined with limited buying from key destinations have continued to weigh on sentiment.

Export quotations for non-basmati 5% broken rice across major Asian ports declined in the week to 29 September 2025, tracking ample global availability and weak import interest. Traders report that elevated inventories in India-the world's top shipper-combined with limited buying from key destinations have continued to weigh on sentiment.

Vietnam and India hold price premiums

Vietnam's Ho Chi Minh Port retained the highest free-on-board offer at $377/tonne (t), easing only $1 from the previous week. India's Kandla Port also remained comparatively firm at $374/t FOB, reflecting steady pipeline demand and aggressive stockholding by exporters despite the broader downtrend.

Thailand and Pakistan lead the correction

The sharpest adjustment came from Thailand, where Bangkok Port offers dropped $9 to $350/t. Exporters there are discounting to stay competitive against cheaper Indian and Vietnamese cargoes. Pakistan's Karachi Port saw a $7 fall to $356/t, as traders trimmed offers to clear inventories and maintain buyer interest.

Myanmar remains the lowest-priced origin

At the bottom of the market, Myanmar's Yangon Port continued to post the most competitive quotes. Prices slipped $5 over the week to $325/t, largely reflecting limited forward bookings and stiff undercutting from regional suppliers.

Buyers hesitate amid policy and price uncertainty

Market participants say buyers are delaying purchases in anticipation of further price erosion. The Philippines' decision to extend its rice import suspension has further tightened buying activity and increased competition among exporters. With import programmes on hold and stocks at multi-year highs across key origins, sellers are under pressure to adjust offers to secure market share.

© Copyright 2025 The SSResource Media.

All rights reserved.