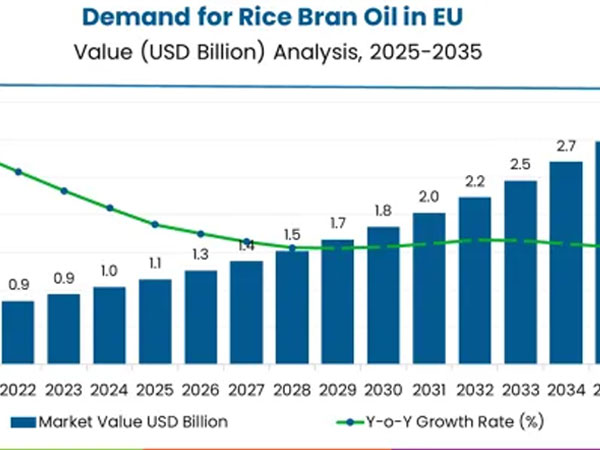

The demand for rice bran oil in EU is projected to grow from USD 1.1 billion in 2025 to USD 3.0 billion by 2035, at a CAGR of 10.1%. Organic will dominate with a 72.0% market share, while food & beverage (cooking, bakery, snacks, dressings) will lead the application segment with a 82.0% share.

The demand for rice bran oil in EU is projected to grow from USD 1.1 billion in 2025 to USD 3.0 billion by 2035, at a CAGR of 10.1%. Organic will dominate with a 72.0% market share, while food & beverage (cooking, bakery, snacks, dressings) will lead the application segment with a 82.0% share.

Demand for Rice Bran Oil in EU: Outlook and Forecast (2025-2035)

The European Union’s rice bran oil sector is set for a robust expansion between 2025 and 2035. Valued at USD 1.1 billion in 2025, the industry is projected to reach USD 3 billion by 2035, growing at a compound annual rate of 10.1%. The rise reflects the region’s evolving dietary patterns, with consumers gravitating toward oils rich in nutrients and antioxidants. Rice bran oil, known for its balanced fatty acid composition and high content of oryzanol and tocotrienols, has become a preferred option in health-conscious households. This trend aligns with the broader shift toward functional and natural ingredients in European diets. The demand surge also benefits from its versatility across culinary, nutritional, and cosmetic applications, making it a multifaceted growth story within the EU’s broader wellness economy.

Demand for Rice Bran Oil in EU - Key Takeaways

- Rice Bran Oil Market Value (2025): USD 1.1 billion

- Rice Bran Oil Market Forecast Value (2035): USD 3 billion

- Forecast CAGR (2025–2035): 10.1%

- Leading Product Type (2025): Conventional (Non-Organic) - 72.0%, USD 818.2 million

- Key Growth Countries: Netherlands, Rest of Europe, Italy

- Top Application (2025): Food & Beverage - 82.0%, USD 931.8 million

- Top Distribution Channel (2025): Hypermarkets & Supermarkets - 44.0%, USD 500.0 million

Between 2025 and 2030, sales across the EU are expected to climb from USD 1.1 billion to USD 1.8 billion, marking an increase of USD 712.4 million. This first phase of expansion is driven primarily by heightened awareness of cholesterol-lowering oils and the repositioning of rice bran oil as a mainstream household product. By 2030–2035, the sector is forecast to add another USD 1.1 billion, reaching USD 3 billion, underpinned by premiumization and the rise of organic cold-pressed offerings. The transformation from niche to everyday cooking oil is emblematic of how European consumers are rethinking health through daily diet choices. The early years of adoption were characterized by curiosity and niche positioning; the coming decade will represent normalization, with rice bran oil achieving a steady presence alongside olive and sunflower oils in EU kitchens.

The EU’s appetite for rice bran oil is expanding as consumers prioritize heart health, clean-label nutrition, and sustainable sourcing. The oil’s naturally occurring antioxidants, particularly gamma-oryzanol, have been clinically associated with lowering LDL cholesterol and improving metabolic profiles. As awareness grows, European households and food manufacturers are incorporating rice bran oil into snacks, spreads, and ready-to-eat products. Beyond culinary use, its emollient qualities are valued in skincare and haircare formulations.

Rising disposable incomes and the popularity of plant-based diets are additional enablers, boosting the oil’s reputation as a versatile ingredient. Importantly, sustainability trends are influencing purchasing decisions, with consumers favoring products that strike a balance between wellness benefits and ethical sourcing, as well as reduced carbon footprints. The combination of nutritional science and consumer ethics is propelling the category into mainstream health product portfolios.

Why is the Demand for Rice Bran Oil in EU Growing?

Industry expansion is being driven by the increasing emphasis on heart health, metabolic wellness, and plant-based nutrition across European households. Consumers are actively replacing traditional high-fat oils with nutritionally superior options like rice bran oil, which offers a balanced fatty acid profile and contains powerful antioxidants such as gamma-oryzanol and tocotrienols. These compounds are recognized for their ability to reduce LDL cholesterol and support cardiovascular health. The convergence of necessity-driven adoption by consumers managing cholesterol and lifestyle-related conditions with choice-driven preferences from health-oriented populations is creating broad, sustainable demand across both mainstream and specialty segments.

The growing body of scientific research highlighting the link between dietary fats, inflammation, and long-term disease prevention is fueling greater interest in oils with proven functional benefits. Rice bran oil fits within this shift due to its natural antioxidant capacity and superior stability during high-temperature cooking. Regulatory authorities across the EU continue to reinforce clean-label and nutritional transparency requirements, giving an edge to producers offering certified organic and cold-pressed variants with verified traceability. Clinical studies and nutrition programs increasingly endorse rice bran oil as a healthy substitute for conventional vegetable oils, supporting digestive comfort, lipid balance, and better nutrient absorption. These scientific and regulatory developments, combined with consumers’ growing demand for functional yet familiar cooking ingredients, are cementing rice bran oil’s position as a cornerstone of Europe’s evolving healthy-eating landscape.

Segmental Analysis

Sales of rice bran oil in the EU are segmented by nature, application, distribution channel, and country. By nature, demand is divided into organic and conventional categories. By application, consumption is distributed across food & beverage, healthcare & nutrition, cosmetics, and animal feed sectors. By distribution channel, sales are classified into hypermarkets/supermarkets, convenience stores, and online retail stores. Regionally, the analysis covers Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

© Copyright 2025 The SSResource Media.

All rights reserved.