Despite a doubling of US rice imports, India’s market share remains stuck near 26% even as Thailand dominates and China quietly expands its footprint

Despite a doubling of US rice imports, India’s market share remains stuck near 26% even as Thailand dominates and China quietly expands its footprint

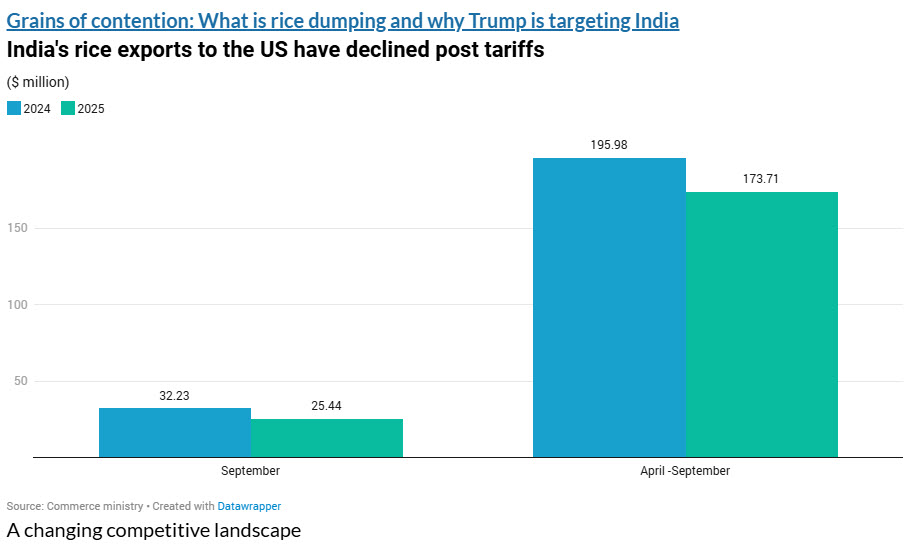

US President Donald Trump's accusations of India dumping rice and threats of fresh tariffs have added pressure on India's rice exports, which already face a 53 percent effective tariff in the US market.

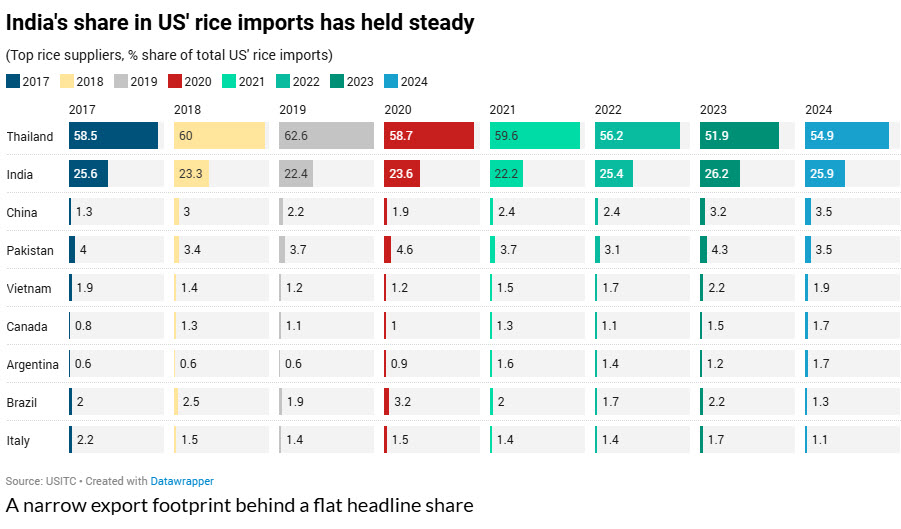

A Moneycontrol analysis of US import data shows India’s share in US rice imports was 25.6 percent in 2017 and 25.9 percent in 2024, little changed despite total US rice imports more than doubling to $1.6 billion.

India has retained its position as the US’s second-largest exporter of rice over the past decade, but its influence in the American market remains almost exactly where it was during Donald Trump’s first term.

India’s steady share masks substantial shifts among competitors. Thailand remains the dominant supplier, accounting for 54.9 percent of US rice imports in 2024. China, meanwhile, has quietly expanded its presence: its share has nearly tripled from 1.3 percent in 2017 to 3.5 percent in 2024, signalling growing competitiveness even from a low base.

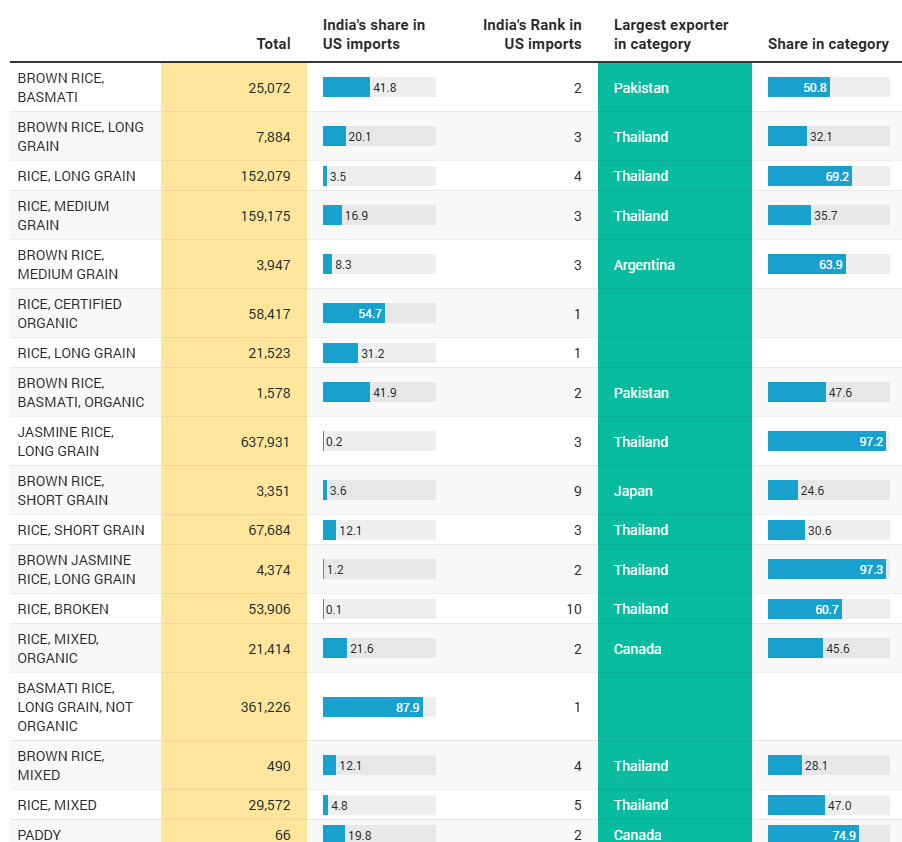

India’s presence in the US rice market is concentrated in a handful of tariff lines. In basmati long-grain (semi- or wholly milled, non-organic), India commands nearly 88 percent of US imports, with Pakistan a distant second at 9 percent. In certified-organic semi- or wholly milled rice (non-parboiled), India holds 54.7 percent, ahead of Thailand. India is also the largest supplier of long-grain parboiled rice, with a 31.2 percent share.

Beyond these niches, India generally ranks second, third or lower. In husked basmati, Pakistan leads with just over half the US market, while India accounts for roughly 42 percent. In many medium- and short-grain categories, Thailand, Argentina, Japan and Canada dominate, keeping India in the single digits or low teens. In jasmine rice, one of the fastest-growing premium segments, Thailand supplies more than 97 percent of US imports; India’s role is marginal.

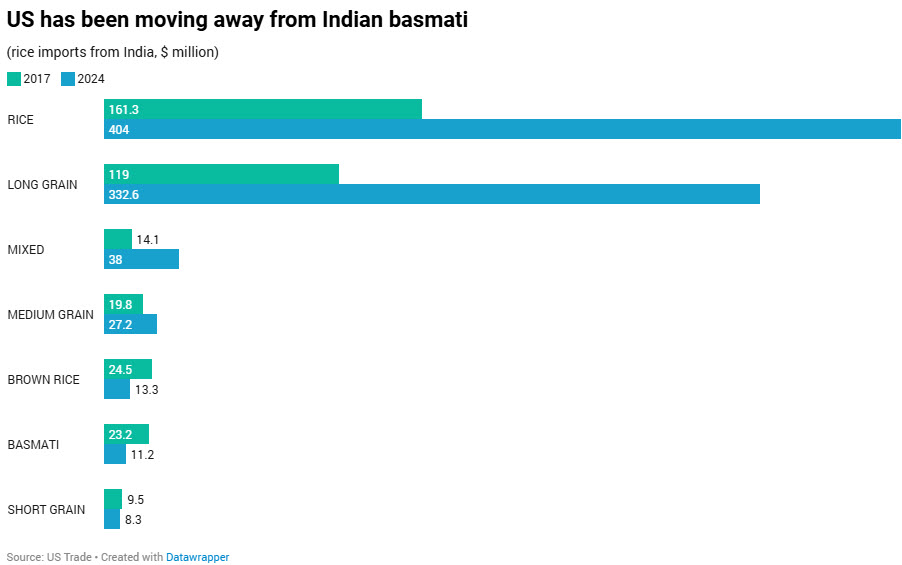

What India sells to the US has changed markedly. In 2017, exports were more evenly split between basmati and other categories. By 2024, the mix shifted decisively toward long-grain non-basmati rice. Exports of long-grain rice rose from $119 million in 2017 to roughly $333 million in 2024. Mixed-grain exports more than doubled from $14 million to $38 million.

Basmati has moved in the opposite direction. Indian basmati exports to the US fell from $23.2 million in 2017 to about $11.2 million in 2024, even as total US rice imports surged. Short-grain exports have edged down, while medium-grain shipments have risen modestly, but nowhere near the pace of long-grain and mixed categories.

Deja vu

The flattening of India’s market share echoes earlier patterns. During Trump’s first term, India’s US rice import share fell to 23.6 percent in 2020 from 25.6 percent when he took office, before recovering above 25 percent in the pandemic years.

© Copyright 2025 The SSResource Media.

All rights reserved.