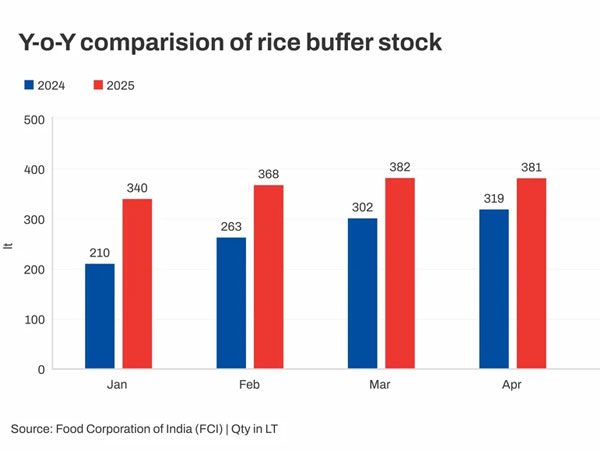

India's rice buffer stocks averaged a record high in the period January-June 2025 or H1CY'25, reveals data maintained with BigMint. Data tracked since 2022 shows buffer stocks of rice held by the Food Corporation of India (FCI), the nodal government agency for procuring and distributing foodgrains and other crops, in H1CY'25 averaged 370 lakh tonnes (LT) against 291 LT in the same period in CY'24, 235 LT in H1CY'23 and 310 LT in H1CY'22.

India's rice buffer stocks averaged a record high in the period January-June 2025 or H1CY'25, reveals data maintained with BigMint. Data tracked since 2022 shows buffer stocks of rice held by the Food Corporation of India (FCI), the nodal government agency for procuring and distributing foodgrains and other crops, in H1CY'25 averaged 370 lakh tonnes (LT) against 291 LT in the same period in CY'24, 235 LT in H1CY'23 and 310 LT in H1CY'22.

Buffer stocks are reserve volumes that the government procures from the farmers through FCI at the minimum support price (MSP) and which can be released in the eventuality of a tightness in supply brought on by crop failure due to unfavourable weather conditions, natural disasters or for even distribution amongst vulnerable portions of the population through the public distribution system (PDS).

Reasons for record high buffer stocks

Higher paddy procurement from farmers: The government engaged in higher paddy procurement from farmers in a bid to offer support to the farming community since physical prices of rice grains (offered by millers) are ruling at discounted levels to the MSP.

As per the latest report dated 18 August 2025, the total paddy area sown so far in 2025, covers 398.59 lakh hectares as compared to 362.92 lakh hectares in the same period last calendar. This is increase of 35.67 lakh hectares or 9.83% over previous year.

FCI data reveals, the government procured around 61 million tonnes (mnt) of paddy in marketing year 2024-25, which spreads over October-September, against 55 mnt in marketing year 2023-24, up almost 12% y-o-y.

Farmers, in order to reap the benefits of the MSP, would rather sell to the government than a private trader. "This has now led to a scenario where most of the country's rice grains are now being held with the government," a source told BigMint.

Higher warehousing capabilities: Consumption uptrends, increased foodgrains production, infrastructure push, and recognition of logistics as a key tool in the advancement of the economy are factors that have encouraged the Indian government to focus on higher and improved warehousing facilities. In 2021, public foodgrains storage capacity rose sharply to 962 LT, because of higher allocations to states amid the Covid crisis. Over July-November 2024, these averaged 819 LT and plans are afoot to create additional 700 LT of silos over the next five years in the cooperative sector.

Better price stability: The government's minimum buffer rice stock requirement is usually at 135-140 LT per month. Currently, the per-month inventory is at more than double, averaging 370 LT/month. Higher buffers help the government to control and maintain prices. Fluctuations get weeded out of the system, helping trade to remain on an even keel. Higher buffer inventory translates into warehousing facilities getting stashed, which, in turn, helps to negate supply tightness and encourages a range-bound price band.

Pre-poll measures: After procurement from farmers, the government does customised milling and then sells in the open market. Part of the inventory is also diverted through the PDS towards populist schemes to benefit less advantaged communities. Populist schemes through PDS become potent vote-bank tools ahead of elections. With key states like Bihar, West Bengal, Tamil Nadu, Kerala and Assam due for state Assembly elections in 2026, populist PDS schemes can come in handy.

Higher auction revenue scope: Part of the inventory is also sold in the open market through auctions. The highest bidder here gets an assured fixed quantity. The large domestic traders and export houses mainly buy from the auctions. The higher the buffer stocks, the better the revenue earnings scope from auctions for the government.

Outlook

With the Kharif season already set in motion with the onset of the monsoon in June, it will culminate with harvesting around October. Expectations are that the trend of high buffer stocks will continue till the end of the Kharif season.

Moreover, paddy plantation is higher this crop season by 20% y-o-y at around 470 lakh hectares (ha) against 440 lakh hectares in the last crop year. This will also support higher buffer stocks for the rest of the crop marketing season.

© Copyright 2025 The SSResource Media.

All rights reserved.